Age limits for life cover – how insurers com...

Posted by Adam Higgs | Apr 24, 2024 | Critical Illness, Life Protection, Minimum/Maximum Limits, Minimum/Maximum Limits | 0 |

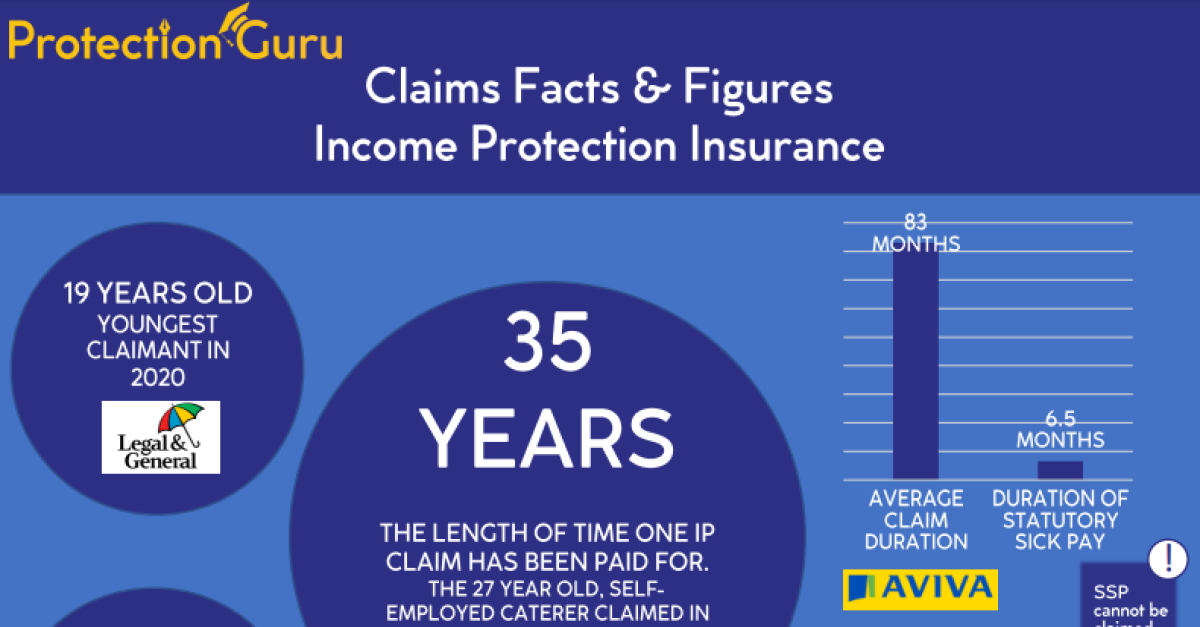

When will insurers waive defer periods for linked ...

Posted by Adam Higgs | Apr 23, 2024 | Deferred Periods, Income Protection, Waiver of Premium | 0 |

Join our Protection Forum

Posted by Adam Higgs | Apr 22, 2024 | Events | 0

My favourite support service so far!

Posted by Adam Higgs | Apr 22, 2024 | Weekly Roundups | 0 |

Join our Protection Forum

Apr 22, 2024

Protection Guru’s monthly virtual Protection Forum brings together visionary...

Read MoreMy favourite support service so far!

Apr 22, 2024

As regular readers of Protection Guru’s Monday morning email will know, I am currently in training...

Read MoreIndividual protection underwriting limits – 4 things you should read

Apr 19, 2024

Understanding when and what medical evidence may be required when recommending a protection...

Read MoreExciting Career Opportunity for a Protection Specialist at Protection Guru

Apr 15, 2024

At Protection Guru, we’re on a mission to demystify the protection and life insurance industry....

Read More

User Details

Contact Us